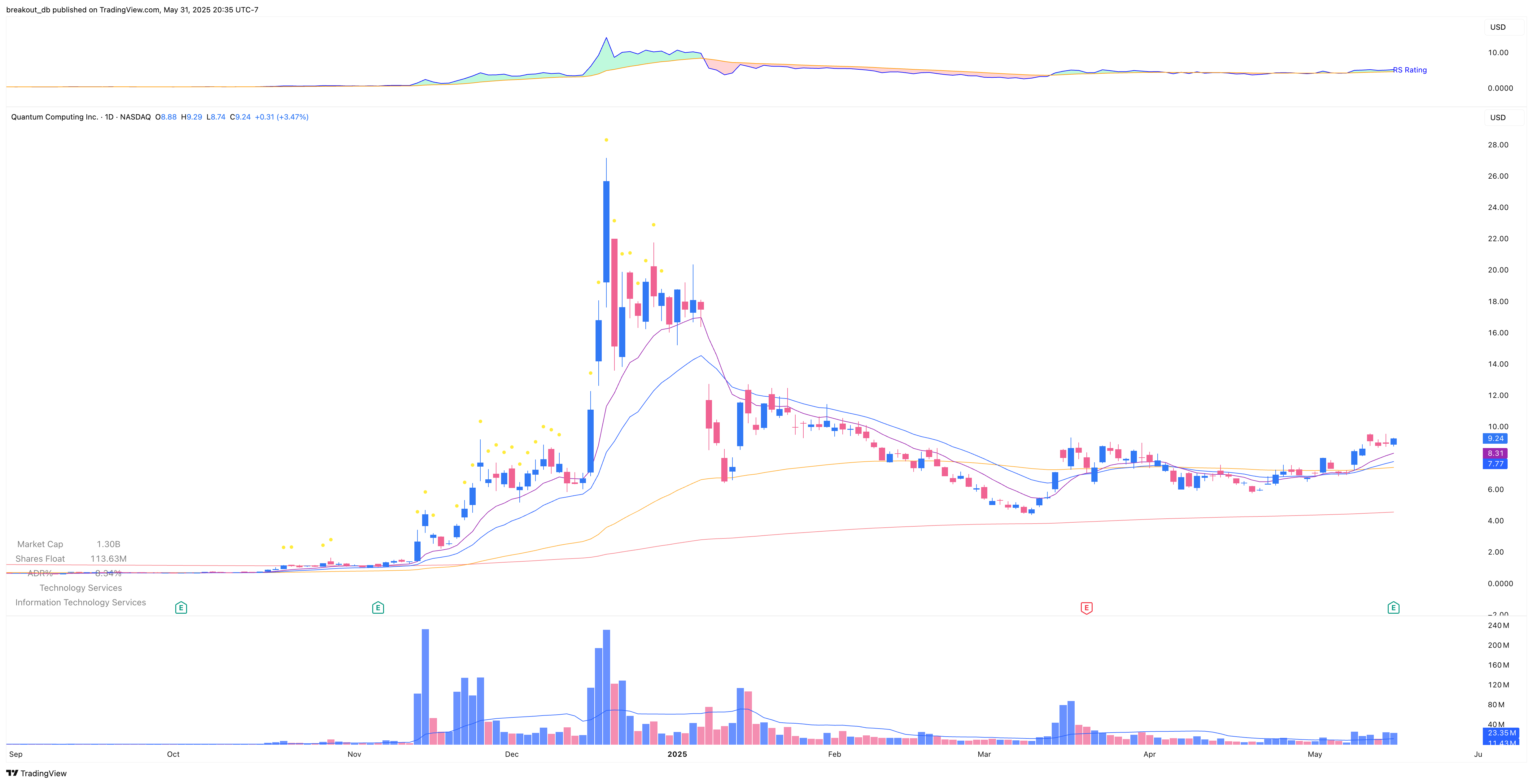

QUBT - Episodic Pivot - 2025-05-31

QUBT Trade Summary

Performance metrics and trade details for QUBT breakout.

- Stage

- 2

- Catalyst

- Earnings Report

- Risk

- 3.6%

- Gain %

- 11.0%

- Market Condition

- Bullish

- Entry

- Breakout

- Stop

- LoD

- Exit

- Extended

- Reward Risk Ratio

- 3.1R

- About

Quantum Computing Inc. (QUBT) had a strong move after a good earnings, which made it a potential Episodic Pivot setup. While the initial breakout offered a small profit for day trader, the lack of follow-through after day one makes it a failure for swing trader holding the position.

Despite the gains on Day 1, the stock did not sustain momentum, limiting the overall trade potential.

The stock got over extended on Day 1, so we can reduce half, the next day it gapped down over 6% so we exit the trade at the open.

The overall gain is 1/2 * 16 + 1/2 * 7 ~= 11.5

Before Breakout Weekly

Before Breakout Daily

Intraday Entry

After Breakout

Market Correlation Analysis for QUBT

Top Similar Tickers

Stocks that move in the same direction as QUBT

| Rank | Ticker | Score |

|---|---|---|

| No similar stocks found in the current universe. | ||

Top Inverse Tickers

Stocks that move opposite to QUBT

| Rank | Ticker | Score |

|---|---|---|

| No inverse stocks found in the current universe. | ||