INOD - Episodic Pivot - 2024-11-08

INOD Trade Summary

Performance metrics and trade details for INOD breakout.

- Stage

- 2

- Catalyst

- Earnings Report

- Risk

- 4.3%

- Gain %

- 45.0%

- Market Condition

- Bullish

- Entry

- OPB

- Stop

- LoD

- Exit

- Reached Target

- Reward Risk Ratio

- 10.5R

- About

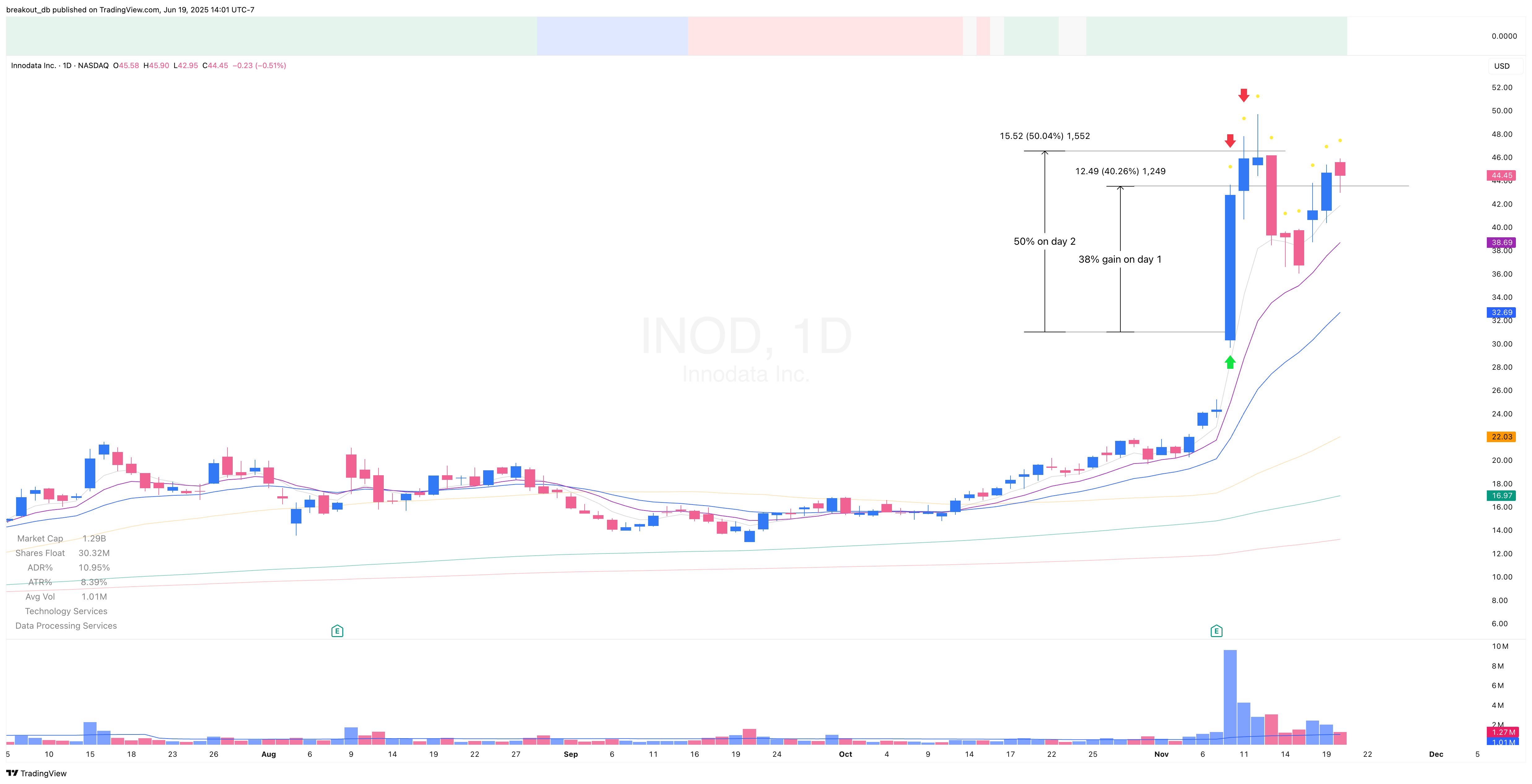

Trade Summary – INOD (November 2024)

INOD posted a blowout earnings report after market close on November 7, 2024 — building on strong results from the previous quarter. The broader market was already surging post-election (Nov 5), setting the stage for momentum.

On November 8, INOD gapped up 25% pre-market and continued trending higher throughout the session. Entering via a 1-minute open range breakout and exit near the final hour for a +40% gain.

Following my trading rules, Day 1 and Day 2 were both extended (10x ATR from 50 SMA). Selling the remaining half position on Day 2 added another +50%, averaging out to about +45% profit across both days.

Before Breakout Weekly

Before Breakout Daily

Intraday Entry

After Breakout

Market Correlation Analysis for INOD

Top Similar Tickers

Stocks that move in the same direction as INOD

| Rank | Ticker | Score |

|---|---|---|

| No similar stocks found in the current universe. | ||

Top Inverse Tickers

Stocks that move opposite to INOD

| Rank | Ticker | Score |

|---|---|---|

| No inverse stocks found in the current universe. | ||