HIMS - OOPS Reversal - 2025-05-05

HIMS Trade Summary

Performance metrics and trade details for HIMS breakout.

- Stage

- 2

- Catalyst

- Earnings Report

- Risk

- 4.1%

- Gain %

- 33.0%

- Market Condition

- Choppy

- Market Cap

- $9.37B

- Shares Float

- 190.4M

- Entry

- KLR

- Stop

- LoD

- Exit

- Signs of Weakness

- Reward Risk Ratio

- 8.0R

- About

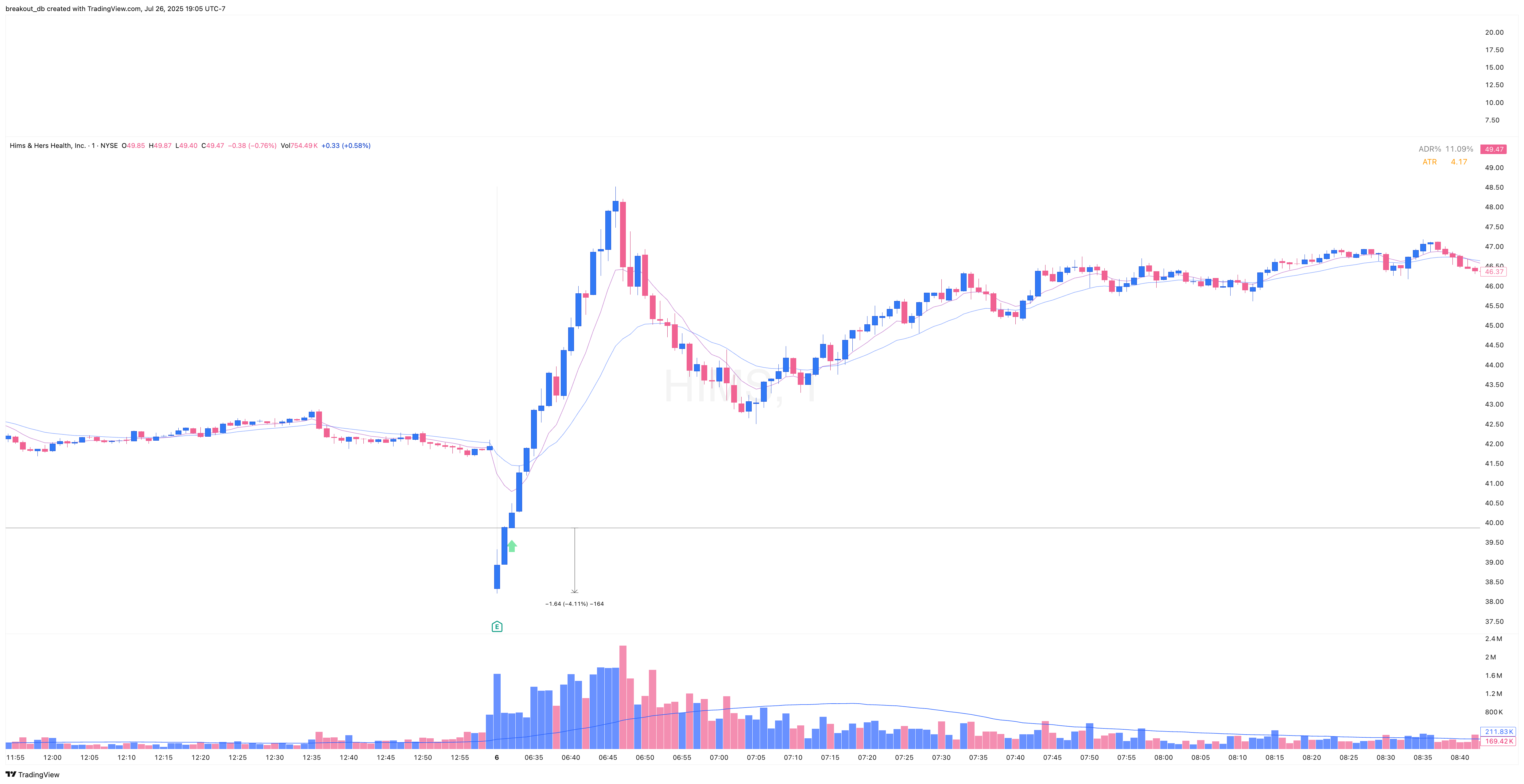

On May 5, 2025, HIMS reported strong earnings with 65% EPS growth and 8.8% revenue growth YoY. Despite this, the stock gapped down 8% the next day but was quickly bought up—triggering an entry via the OOPS reversal setup.

A few days later, a 5% pre-market gap down signaled potential trend weakness, so one can take a exit with a 33% gain in just a few days.

Before Breakout Weekly

Before Breakout Daily

Intraday Entry

After Breakout

Market Correlation Analysis for HIMS

Top Similar Tickers

Stocks that move in the same direction as HIMS

| Rank | Ticker | Score |

|---|---|---|

| No similar stocks found in the current universe. | ||

Top Inverse Tickers

Stocks that move opposite to HIMS

| Rank | Ticker | Score |

|---|---|---|

| No inverse stocks found in the current universe. | ||

Related breakouts

More to study.

Table of breakouts

| Company | Catalyst | Gain (%) | Chart | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 1 | JMIA | OOPS Reversal | May 8, 2025 | Bullish | Earnings Report | +53.0% | Detail https://breakoutdb.com/jmia/jmia-oops-reversal-2025-05-08/ | ||

| 2 | PENG | OOPS Reversal | July 9, 2025 | 2 | Bullish | Earnings Report | +12.2% (*) | Detail https://breakoutdb.com/peng/peng-oops-reversal-2025-07-09/ |

(*) This trade is still active; the gain is an estimate based on the current price.